|

|

Direct short-cut to this page:

http://bit.ly/12nLSS2

Updated 1255 on May 30, 2013

|

|

Direct short-cut to this page:

http://bit.ly/12nLSS2

Updated 1255 on May 30, 2013

To: Everyone who wants to know more about the Measure 8-71 Tax Levy

Subject: Know what the bill is all about and what was at stake

From: Curry PAC

The Curry PAC is running a campaign in Curry County to encourage registered citizens to approve the Law Tax Levy Measure 8-71. Voting deadline was 8 PM on May 21, 2013. Measure failed, 56% to 44%.

Five Important Steps for

Late Voters

Endorsements

Late

News

Q&A

Historical

Significance

Political

Mythology

Response to Pilot

Letters to the Editor

Results of the

Vote: Curry

- Failed, Josephine

- Failed, Lane

- Passed

Endorsements (Chick here.)

Brookings-Harbor Chamber of Commerce

Board of County Commissioners - Page 1, Page 2

Central Curry School District # 1

Curry County Democratic Central Committee

Curry County Republican Central Committee

Senator Jeff Kruse & Representative Wayne Krieger

Port Orford-Langlois School District 2CJ

Financially

troubled Oregon counties face critical turning point locally, in

Legislature and in D.C. - Oregonian May 11, 2013

Grants Pass is 'wasteland of

criminals" - Daily Courier

End of the line - Medford Mail

Tribune April 14, 2013

What are the Fiscal Problems Facing Curry

County: 01,

02,

03,

04,

05,

06,

07,

08,

09,

and 10

What were the Citizens Committee

Recommendations: 01,

02,

03,

04,

05,

06,

07,

08,

09,

10,

11

and 12

What is Measure 8-71?

County Law Enforcement Five Year Split Rate Operating Levy Measure 8-71

Shared State-County Services

Mandated County Services Quick Reference Guide - 2011

Mandated Services Reference List - 4/1/09

Public Safety Levy by Category

Impact of numerous "No votes" in Josephine and Lane County's

Why do we need Measure 8-71?

How much has assessed values of homes in Curry

County gone up or down by year for the last five

years?

How can I estimate my property tax

increase?

In figuring that rate, how does Assessed rate

vs. collected rate apply?

How much will my increase

be?

Where do I find the assessed value of my

home that will be used when this takes effect?

What if I can't afford to

pay?

What happens if a better funding

source for the County becomes available before the 5 years is up. Are

we committed to continue charging property owners the increased

tax?

What will happen if it fails?

What happens to the County's Public

Safety if 8-71 fails?

Grants Pass is 'wasteland of criminals" - Daily Courier

What is Oregon House Bill 3453 and how might it

affect Curry County Citizens? House

Bill 3453 Text

What is Oregon House Bill 2206 and how might

it effect Curry County Citizens? House

Bill 2206 Text

What is Oregon House Bill 2168 and how might

it effect Curry County Citizens? House

Bill 2168 Text

What is Oregon Senate Bill 173 and how might it

effect Curry County Citizens? House

Bill 173 Text

Economic Facts

Oregon Kitchen Table Final Results

- 01,

02,

03,

04,

05,

06,

07,

08,

09,

10,

11

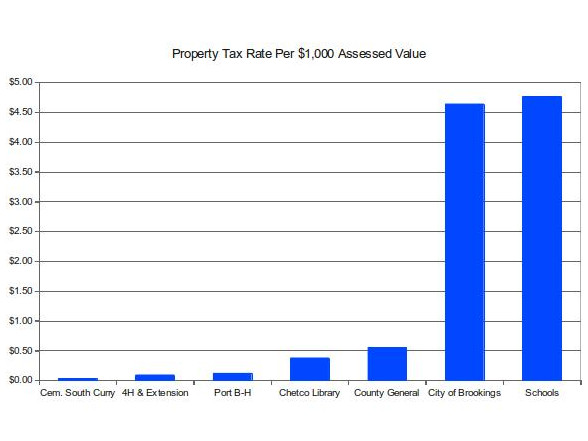

Current Property Tax

Rate - Graph

Oregon

County Property Tax Rate by County 2012

City Tax Rate

Current Tax

Rate

Budget

Message of Curry County, Oregon Fiscal Year 2013-2023

County

Law Enforcement Five Year Split Rate Operating Levy Measure

8-71

2013-2023 Proposed Budget - 2-1 million - Proposed

2013-2023 Proposed Budget -Law Levy - Proposed

Veterans Services

Officer

Response from Elections

Division of the Office of the Secretary of State, Salem Denying

Thomas Huxley's Allegation of Oregon Election Law Violations by Curry

County Commissioners Smith & Itzen, Page

2

Thomas Huxley's Allegations

directed to Secretary of State Brown, Page

2, Page

3

Curry County 2.1

Budget - Draft

General Fund Expenditure Budget

2012/13 - Pie chart

General Fund Personal

Services - Pie chart

General Fund Support Requirements

2012/13 - Pie chart

General Fund Discretionary Revenue

2013/14 - Pie chart

General Fund Discretionary Revenue

2013/14 - 2 - Pie chart

Will development replace secure

rural schools payments?

Curry County Property Tax

Rate = $0.5996/$1000 AV

Number of New $2,000,000 RMV

McDonalds Restaurants to Generate $3,121 Million

Number of New $1,000,000 RMV

Golf Resorts Required to generate $3,121 Million

Order No. 13839 -

Directing that an election be conducted on May 21, 2013 relating to a

five year local option tax for law enforcement purposes. Page

2

County Law Enforcement Five Year

Split Rate Operating Levy

General Fund Cash

Balance - Graph

General Fund Cash Balance 2

- Graph

New Discretionary Resources

- Graph

Letter to Governor Kitzhaber from

Curry County Commissioners , Page

2- 9/7/2011

Reply from Governor

Kitzhaber, Page 2 -

10/21/11

Curry County # of Employees

- Graph

Curry County officials say tax

measure is only way, Page

2, Page 3 -

Pilot 1/30/2013

State

of the County Address - December 19, 2012

Oregon’s

Counties: 2012 Financial Condition Review

Curry

County Self Proclaims a Financial Emergency - April 13,

2012

Estimating

Potential Sales Tax Revenue in Curry County - April,

2012

Research

Brief on Estimated Curry County Goods Sales Tax

Revenue

Governor

Kitzhaber’s Response To Curry County’s Potential Return of

Services - March 2, 2012

Potential

Return of County Services to State – Letter to Governor

Kitzhaber - February 15, 2012

Curry

County Declares a State of Emergency - January 23,

2012

Support

from Oregon Consensus - November 2, 2011

Economic

Collapse of Oregon Rural Counties, A Statewide Concern by

Dennis Richardson

Governor

Kitzhaber’s Response To Curry County’s Financial

Crisis - October 20, 2011

Urging

the House Natural Resource Committee for Decisive Action -

September 21, 2011

Request

for Support of Curry County as an Oregon Solution Project -

September 21, 2011

Curry

County’s Financial Crisis - Letter to Governor Kitzhaber

- September 7, 2011

A

Review of Conditions in Curry County - Oregon Solutions Final

Report - September 2, 2011

Supplement 1: Sheriff John Bishop RE: Oregon Solutions Final Report - October 3, 201

Supplement 2: Corrections to the Oregon Solutions Final Report

Community

Outread - Economic Forecast - June 2011

Curry

County Budget Town Hall Meetings - June 2011

Curry

County Law Enforcement Tax District Study - September 1,

2009

Amendments to 3453 for state to pay

half - Short-cut

One's entire tax bill will

triple!

The levy will last longer than five years

because once you have a tax it just stays and gets

bigger

We don't need a tax increase because there is

still lots and lots of fat in the county budget so additional cuts

will solve our problems

The real problem is the overly generous

public pension system.

People won't move to Curry County if we

raise property taxes because they come here now for our low

taxes.

Why should I pay for schools since I don't

have school-aged children? Why should I pay for the jail since

I'm not a criminal so I don't use that county service? Why should I

pay for the District Attorney, Juvenile Justice system, since I don't

use those services.

The county tax calculator is

wrong!

Five Important Steps for Late Voters

Are you the type who waits until the last minute to get all the

facts to

make an informed decision. You still have time! Try this

5 Step Process.

Step 1: Get on the Internet. Watch this video http://bit.ly/10pPMd6

Step 2: Need more reasons? Click here.

Step 3: Find your ballot, turn it over, and vote YES on Measure 8-71

Step 4: Put your ballot in its envelope, put that envelope in the mailing envelop and sign that envelope.

Step 5: DON'T mail it - deposit that envelop in one of these drive-up dropboxes before 8pm Tuesday, May 21st.

Political Mythology

Measure 8-71 failed by a vote of 56 to 44%. It might have gone the other way had more than 55% of registered voters actually made the tremendous effort to open the ballot that they received by mail, voted, sealed it up, put a stamp on it and mailed it. No finding a parking place at the polling location, waiting in line for hours, you know the drill if you've ever voted it another state. Or, it might have won if at least 420 voters who voted against 8-71 did so because they believed the misinformation that Gary Milliman, Brookings City Manager, has been promoting. Primarily that there is a bill in the legislature that would have the state pick up 50% of the cost of mandated services. This is not the case.

Background

At the May 13, 2013 Brookings City Council Meeting, the City Manager (Gary Milliman) provided a Council Agenda Report on the Status of HB 3454 for "Information only." Included were proposed amendments to HB 3453, a letter from Chris Fick of the League of Oregon Cities to Milliman with attachments to come which included a document titled "Hearing held on county fiscal challenges public safety concerns" which was an information hearing of the Task Force on O&C Counties.

This was a follow-up to a previous report dated March 25, 2013 Proposed County Public Safety Property Tax Levy Council Agenda Report with the Measure 8-71 attached.

Milliman's Claims

In his May 13 Council Agenda Report he claimed

1. A hearing on the Bill was held on May 1 at which the Bill (3453) was substantially amended. (Note, this was an informational session of the Task Force for O&C county's. "The Task Force, however, isn't empowered to pass or amend bills. They just gather and vet information/ideas." says Chris Fick of the League of Oregon Cities)

2. Some key changes include: (there were no changes made to the bill since this is not under their authority.)

a. The Governor would be required to confer with all local governments in the affected County prior to declaring a public safety fiscal emergency.

b. Authorizes the Governor to enter into intergovernmental agreements on behalf of counties, but not on behalf of cities or other units of local government. Cities could opt-in to intergovernmental agreements, but could not be forced to do so.

c. Requires the County to levy an income tax surcharge to pat for 50 percent of the cost of public safety services; the State would pay the other 50 per cent recognizing that the issues of economically depressed timber counties is one of statewide concern.

d. Limits the scope of intergovernmental agreements to public safety related function and activities.

3. According to the League of Oregon Cities, HB 3453 no longer contains any provisions that could be interpreted as authorizing the Governor to "takeover" local government, levy or increase taxes, consolidate cities and counties, or take money from one local government and transfer it to another.

4. The Bill (3453) has, essentially, been amended to address the concerns expressed by the three Curry County Mayors and no longer poses a threat to "local control."

These claims that these amendments have been made to the bill are false. As of 5/25/13, the bill is still in the Rules Committee which has not held a hearing on the bill. Now that Curry voters have revealed their intention not to take responsibility, I surmise that action will pick up shortly on this and others bills that have been held in committee until the legislature saw the direction Curry County voters choose.

This being said, NONE of the amendments have made it into the bill and 3453 is still intact as originally drafted.

One of the features of the League of Oregon Cities amendment is the one that makes the state pay half the cost of bailing out Curry County.

Tom Bozack asks, "If you were a legislator from another district, would you vote for a bill that sticks your constituents with helping to pay the cost of bailing out a county that won't pay for itself? I don't think so! It's far more likely that Curry County will end up paying for it's own county government one way or another. The only question is whether we have a say in that process or it is dictated to us by Salem."

"It seems that there are some local public officials who blatantly construed the facts for self interest. The actions of repeatedly misinforming the public by these elected officials is irresponsible, DOES NOT show leadership and is a violation of their oath of office, in my opinion," says Commissioner David Brock Smith.

Senator Wyden's Comments before the Measure 8-71 vote concerning getting more Federal funds: "Communities and states have a responsibility to do their part to generate sustainable revenues through tax levies, economic development and other solutions. Communities like Lane, Josephine and Curry counties that are seeking their own sources of revenue comparable to other states and regions are taking exactly the right approach. This will give people in those communities greater control over their own futures and more independence from the federal government." I guess the Brookings leadership and the majority of Curry and Josephine County voters either didn't get the memo or choose to ignore it. What were they thinking?

Summary

"It would be a little like watching someone's boat sink and not throwing them a lifeline - just stepping back and getting out of the wake," said Rep Bruce Hanna, who helped craft HB 3453. "And I don't think that's responsible."

(The voters of Curry County have spoken. The Law Levy failed. Apparently, most Curry voters think Salem can do a better job running our County than our own county and local governments.

Unfortunately, with so much misleading information coming out of Brookings' City Hall*, our chance for a brighter future has dimmed. We missed a great opportunity to show Congress, in support of Senator Wyden's O&C lands bill, that we want to take responsibility to see our county move forward. The vote is a sure indicator to Congress and to Salem that we will continue to rely heavily on federal and state support and not accept any more responsibility for our own Public Safety than we already have done. We are the leading Me! Me! Me! county in Oregon and are not interested in contributing for the good of the whole. The Feds drilled the first hole in the bottom of the sinking County boat. Every time since that the Commissioners have put forth a Tax Levy, Curry County voters say "NO" and pick up the drill and drill another hole.

Representative Bruce Hanna, who helped craft HB 3453, said it would be irresponsible not to throw Curry County voters another lifeline. Please Wyden, Merkley, DeFazio, Hanna, Kitzhaber. STOP throwing us last minute life lines - it's obvious, it's time we learn how to swim.

My hope is that Congress and Salem will stop being our enabler. It seems that we've got to hit rock bottom before we wake up. If we don't wake up, we deserve what ever we get.

It reminds me to the obese humans in the classic movie "WallE". They need to get up off their collective asses and do something positive - like contribute for the good of the whole. A property tax covers everyone - property owners and renters. Both income tax and sales tax affects the middle and lower class substantially more because it takes a much greater percent of their total spendable income. Plus it's a major expense on retailers and County government to do the collections.)

Amendments to 3453 says state to pay half. There is no indication in the legislature that any action has been taken to incorporate these amendments in 3453 and the bill stands as proposed.

"The amendments have been drafted and can be access via the bulletin link Kevin sent you (http://bit.ly/YYTJFc). They have not been adopted by the Rules Committee, where the bill currently resides. The committee hasn't held a hearing on HB 3453 yet, though the O&C Task Force did. The Task Force, however, isn't empowered to pass or amend bills. They just gather and vet information/ideas." Chris Fick, League of Oregon Cities

Kevin Toon, Communications & Marketing Manager, League of Oregon Cities wrote "Here is a link to the May 3 edition of our weekly e-Bulletin; on page two you’ll find an article about HB 3453 and the proposed amendments (“Hearing Held on County Fiscal Challenges…”):

"HB 3453 would create a mechanism allowing the governor and legislative leadership to proclaim a public safety emergency in a county. As originally drafted, the bill would empower the governor to consolidate or merge local governments in the affected areas and enter into intergovernmental agreements on their behalf. In order to fund the necessary level of public safety services, the bill allows county commissions to impose an income tax on residents and businesses.

"The League of Oregon Cities strenuously objected to HB 3453

as originally written but amendments

have been drafted that exclude cities and special districts from the

governor’s authority. The amendments also decrease the amount of

local income taxes necessary to support local public safety services

to 50 percent of costs, with the remaining 50 percent borne by the

state. Cities and other local governments would be able to enter into

intergovernmental agreements with the county and/or the state to help

provide services, but would be able to do so at their

discretion."

Source: www.orcities.org/Portals/17/Publications/Newsletters/Bulletin/Bulletin05-03-13.pdf

- page 2.

One's entire tax bill will triple! Ignores the fact that the proposed levy will only affect the small portion that goes to County's General Fund

The levy will last longer than five years because once you have a tax it just stays and gets bigger Ignores the fact that the levy absolutely sunsets in five years and can only continue with another vote.

We don't need a tax increase because there is still lots and lots of fat in the county budget so additional cuts will solve our problems Ignores that fact that cuts over the past two years or more have left the county budget bare bones, services bare minimum, county workforce cut dramatically.

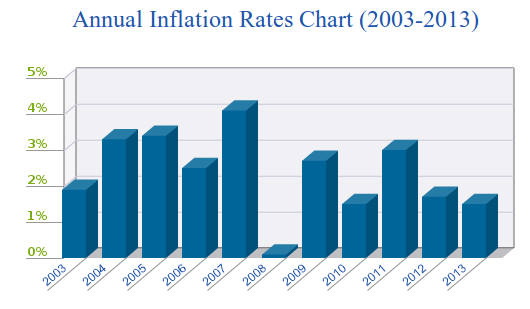

The real problem is the overly generous public pension system. While the system needs some alterations, currently being argued in Salem, this demonizes public employees, and the most significant cause of problems with the retirement system is the huge investment losses caused by the 2007-2008 Great Recession since most pension plans were heavily invested in the stock market and lost at least 40% of the value of the pension plan holding.

People won't move to Curry County if we raise property taxes because they come here now for our low taxes. If the levy passes Curry County will still have the fourth lowest combined tax rate in Oregon So if people won't move here, they won't move to Oregon at all since almost any other place in Oregon will have higher rates.

Why should I pay for schools since I don't

have school-aged children? Why should I pay for the jail since

I'm not a criminal so I don't use that county service? Why should I

pay for the District Attorney, Juvenile Justice system, since I don't

use those services. The new levy doesn't involve an increase in

property taxes that goes to the school districts plus every resident

of a community benefits greatly from having an educated young

population. It's having a community focus instead of on oneself as an

isolated island. Criminal justice benefits all by appropriately

handling law enforcement and keeping our community in general safe

and secure. Quality law enforcement benefits everyone.

5/8/13

All ideas considered? Shae Mordja, Gold Beach

Lies and scare tactics - Edward Ramsey, Brookings

Vote no on tax levy - Thomas Huxley, Harbor

Make do, curryites - Melissa Bishop, Elk River

5/11/13

You want it? You pay - Edwin Ajimine - Brookings

Relieved to Note - Janet Richey - Brookings (Talk of scare tactics.)

Starve the Leviathan - John M. Johnson - Brookings

Local Hasn't Worked - Gary Smith - Pistol River

Burden on our Backs - Don Vilelle - Brookings

Can You Imagine? - Clifton Siemens - Brookings

Preposterous Tax - Mike Schrum - Brookings

Regret Vote for You - Jim Clarkson - Brookings

Strange Bedfellows - Mike Adams - Brookings

5/15/13

Yes of No, You Pay - Ryan Scott - Harbor

I do not support 8-71 - Patricia Ramsey - Brookings

5/18/13

silence is deafening - Roger Mitchell, Brookings

All ideas considered? Shae Mordja, Gold Beach

Question?

In this time of budget crisis for everyone from the government down to the citizens who fund it, has anyone considered cross-training police and fire? Of course there are pros and cons, but has it even been considered and researched?

Have all routes to keep the burden off of the taxpayer truly been thought of?

Response:

All fire departments in Curry County are staffed by unpaid volunteers. Only Brookings has two paid full-time staff, a fire chief and assistant. Their duties don't allow spare time to perform other duties. But more importantly, law enforcement is a complex and demanding discipline. It requires highly trained and motivated people and is not amenable to part-time performance by individuals in unrelated jobs.

Lies and scare tactics - Edward Ramsey, Brookings

Once again we are being inundated by the county commissioners, a PAC (Political Action Committee; which by definition has a political agenda), and articles in the Curry Coastal Pilot trying to convince us taxpayers that they alone know what is good for us, and we better watch out and do what they say or the “bogeyman” will get us!

The truth is that voting for Measure 8-71 increases our property taxes by a ridiculous 27 percent in one year alone. This claim, that if we don’t vote for this tax increase the county will be taken over by the state, is a scare tactic being used by these people who have a political agenda to increase our taxes, since they have been unable to justify this tax increase using the truth.

Do you really trust a PAC and the same inept county commissioners who got us into this financial mess, and who now want to push through an admittedly flawed tax increase using the excuse that we suddenly have an unforeseen crisis?

So we now have a miracle occurring: Both the Democrat and Republican central committees are supporting Measure 8-71! This is not a miracle; this is just further proof that there is really no difference in the entrenched leadership of either party.

My sincere congratulations to the Brookings City Council members for their wisdom and courage in standing firm against the browbeating rhetoric of these “concerned citizens,” with their political agenda to increase our taxes.

May I respectfully suggest to those who want us taxpayers to pay the higher county taxes required to support their agenda for an ever-expanding government, feel free to move to one of those higher taxpaying counties; and, please, take your PAC and these county commissioners with you!

Response:

Facts are not scare tactics. The fact is that the County will not be able to function after mid 2014 with its current revenue base. Until recently most County revenue came from federal timber payments. These payments have ended, leaving only property tax revenue to fund county functions.

A takeover by the state is not a scare tactic. There are currently three bills in the state legislature that enable the Governor to temporarily take over the operation of bankrupt counties so that mandated services will continue to be provided. Mandated serves, as the word implies, are mandatory. The state will not allow Curry County to default on its obligation and fail to provide mandated services to its citizens.

The current commissioners can't be blamed for the failings of the past. The current commissioners acted responsibly by formulating a workable plan to address the County financial crisis.

County government is not expanding, it's shrinking. The current number of full time equivalent county employees is half of what it was in 2008.

Opposition to the measure from the Brookings City Council is disingenuous. The Brookings City Council asserts that the county can continue to function with its existing property tax revenue while at the same time justifying a combined city property tax rate almost 700% higher than the county's. This chart shows the property taxes paid by Brookings residents. The current property tax levy for the county general fund is not much more that of the Chetco Public Library, but it's a small fraction of the combined Brookings city levy. Yet the Brookings City Council want us to believe that the County can continue to provide to the incorporated areas most of the services provided for its residents, plus other county functions that the city doesn't need to provide because they are provided by the county. These include the jail, juvenile detention services, adult parole and probation, district attorney, courts, civil process service, tax assessment and collection, elections, etc.

* * *

Vote no on tax levy - Thomas Huxley, Harbor

This letter is regarding recent public meetings of the Curry County Budget Committee and the last minute cancellation April 24 of a committee meeting scheduled April 25 at 6 in the evening allowing citizens to ask budget-related questions of commissioners.

Commissioner staff advised the meeting “was canceled on 4/17 due to scheduling conflicts of commissioners and some of the budget committee members.” Staff will not provide the commissioner or committee member names. The meeting has not been rescheduled.

During the last Budget Committee meeting held April 17, Commissioner Smith referred to the meeting on April 25 being for the “public’s benefit.” About 15 minutes into the meeting, discussion on the commissioners’ department budget began. Committee member Tom Brand made a motion to transfer $160,000 from the commissioners’ budget to perhaps building and maintenance where it could be better used. Smith responded to Brand stating, “… the core of county government is the commissioner’s office. Other departments cannot function without the commissioner’s office.”

Commissioner Itzen addressed Brand saying “That’s a bucket that is so deep in terms of deferred maintenance that no matter what we do, you could throw five years budgets into that and it wouldn’t solve the problem of maintenance. In fact, I think six or seven years budgets wouldn’t solve the entire problem of maintenance.”

OK. So taxpayers approve the Tax Levy for $24 million over five years so commissioners can “solve” the county financial problem. Commissioners will quickly ask for more $$$ because additional criminals are arrested by additional law enforcement personnel and are overcrowding jail facilities which are unsafe, inadequate and must be maintained or, the criminals will be released to prey upon the citizens.

Vote NO on the Tax Levy.

Response:

The County budget shortfall is approximate $4.5 million per year. Transferring $160,000 from the commissioners’ budget to building and maintenance won't solve the problem. Concerning what the writer says will happen in the future, perhaps he should use his precognitive talent to invest in the stock market or buy lottery tickets. Maybe he will be generous and donate part of his newly acquired wealth to the County so that the rest of us can still have a functioning county government without having to pay for it.

Make do, curryites - Melissa Bishop, Elk River

In three weeks we get to vote on raising our taxes to keep the sheriff’s department funded to the $5.4 million a year that they desire.

In the last few years Curry Countians have had to make do with a lot less. The cost of living has gone through the roof. Yet we have had to somehow survive within our budgets. Where is all this extra cash for the tax supposed to come from?

May I suggest the county mounties learn to live within their $2.1 million budget. Consider if the tax levy did not pass. People who live in towns would still have their local police. State troopers would still patrol Highway 101. And it would still take a long time for the sheriffs to get to my place on Elk River if needed. Chance of that happening in the next five years? Zero.

Response:

From the February 15, 2013 issue of the Curry Coastal Pilot (www.currypilot.com/News/Local-News/Sheriff-Salaries-no-secret):

Under the budget approved for the fiscal year 2012-2013, sheriff’s patrol deputies make $50,094 a year. The jail deputies make $47,018. And civil deputies make $47,018.

The problem is, there aren’t enough of any of them, Bishop said.

A comfortable staffing level — not one that’s extravagant or one that’s so lean it worries him — would comprise 12 patrol officers, 14 in the jail, one more civil officer and, ideally, one more in 911.

Currently, the seven 911 operators have been deputized so they can help run the jail as there aren’t enough people — Bishop has 10 jail deputies — to do so. Bishop’s five patrol deputies often have to return to Gold Beach to help in the jail — where law requires a minimum of two to be on duty there — or escort prisoners from jail to court.

His one civil patrol officer, whose job is to work on restraining orders, foreclosures and other legal paperwork, jumps in to help dispatch. Those in the parole and probation departments help in the jail as well. A volunteer serves papers, otherwise that would fall to a patrol deputy. The parole and probation administrative aide is known to help out in 911.

Even Bishop takes to the roads to respond to emergencies, or helps in the jail, serves as court security and escorts prisoners to court.

That’s with a $3.8 million budget. If he were to work with a $2.1 million general fund budget, law enforcement would be provided with $1.5 million of that — which is virtually impossible, Bishop said.

County officials have said 65 employees would have to be laid off if the tax levy fails.

“When they’re doing two and three jobs and you have to lay them off, you don’t just feel the pinch,” Bishop said. “You get decimated.”

The cost of living isn't going through the roof.

Legend: Red are Editor's comments.

You want it? You pay - Edwin Ajimine - Brookings

I am a registered Democrat and have found that there are many other Democrats who feel like me: We say no to a property tax increase.

For the past few years instead of a pay raise, I have seen one to three furlough days a month. Property values have dropped but property taxes have not. In reading the front page news, it appears that our editor is pushing this tax agenda upon the readers.

Some of the letters to the editor insinuate that it is the rich property owners who are against the tax. Some say it is only Republicans who are against the tax. Look again.

Most homeowners are against this tax and most of us are not rich. Most are on limited fixed incomes and already pay a property tax along with our monthly mortgage. (Unfortunately, you haven't been contributing to 2/3rds of the counties budget for years and now it's time to take responsibility as the country deals with it's own sequester issues.) Are these homeowners the ones who use most of the sheriff’s resources?

I vote that the people who need and want to use these resources foot the bill. (Which of these services do you use or have any chance of needing in the future?) Anyway, why does the sheriff need an additional five million five hundred thousand dollars a year?? (Click here.)

Relieved to Note - Janet Richey - Brookings (Talk of scare tactics.)

I am relieved to note that the state is not planning on taking over or governing counties or cities of Oregon which are in financial distress.

HB 3453 no longer contains any provisions that could be interpreted as authorization for the governor to take over local government, levy or increase taxes, consolidate cities and counties, or take money from one local government and transfer it to another. (Unfortunately, Janet, this simply isn't true. There have been NO CHANGES to 3453 and while the League of Oregon Cities has drafted some potential amendments, the bill has yet to have a hearing and when that time comes, it is doubtful the amendments will pass, especially the one having the other 35 districts pick up half of the cost of state supplied services to Curry County. (Read More)

w, perhaps we can get on with some long term solutions to our county’s financial crisis that is based on fact. Isn’t it wonderful when managers manage?

Our city mayors and managers are to be commended for utilizing a sound system of government on our behalf. (An example of this sound system you elude to above - disseminating false information which is the basic subject of your letter is a big part of that.)

Starve the Leviathan (the Biblical sea monster?) - John M. Johnson - Brookings

The scare tactic about the Mexican Mafia waiting in the wings has been met with skepticism. (Read more and more.)

So the powers that be have trotted out another bogeyman for a return performance. If a loved one dies at home, you may have to wait hours before a deputy sheriff arrives to investigate and allows the undertaker to remove the deceased.

Of course, the obvious solution would be to have a reserve or per diem deputy who is also a licensed medical professional, be on call. (One person, 24/7 for the whole county? Right.) He/she could respond and handle the matter. But I am sure the labor union which represents the county employees would have something to say about that. Showing the public what could be accomplished without paying a full-time salaried employee to do the task is not good for business.

People must realize the leviathan (government) never concedes power. It will always seek to grow by imposing more fees and higher taxes. (See the proposed 2013/14 budget with the tax level and find $4.5 million you're ready to do without.) And, it uses fear and other tactics, counting on the low-information voters, to perpetuate its existence. I saw this firsthand when I served on the budget committee for the city of Brookings.

Property owners will always be in the government’s gun sight because they are the easiest targets. Do not seriously talk about across-the-board salary and benefit cuts and contract renegotiations. Do not even mention establishing a lower-cost, countywide law enforcement district. And do not even think about giving us voters the option of a local sales tax, which would spread the burden out more. (See the Citizens Committee Recommendations and the Kitchen Table survey.)

Let’s just target the fixed-income property owners. And be sure not to mention Curry County has known this debacle was coming for the last 11 years I have lived here. (Your recommendation appears to be a continuation of not dealing with taking care of mandatory services - which won't happen because Salem won't let it happen.)

It is time to starve the leviathan.

Local Hasn't Worked - Gary Smith - Pistol River

The scare tactics coming from all sides to promote the Law Levy Tax Bailout fails to mention that the crime rate in Josephine County is high because you have three to four times the rural population in that crime infested area, therefore three to four times the crime rate as opposed to Curry County — higher insurance rates for us overburdened property owners seems dubious. I contacted all four of my insurers: Hartford said any increase not likely, Progressive said it’s not in any future plans because of our lack of county services, Country Insurance answered it would require a crime wave unsurpassed to consider such an increase in such a small populated area, and Medicare declined to comment without government approval from higher up! (What you are saying is that Hartford, Progressive and and Country Insurance have not and do not expect to increase insurance rates in Josephine County? As of this update, we haven't heard back from the major local insurance companies - Farmers and State Farm - to see what they say.)

Local control has not worked! Local control has done absolutely nothing to improve the law enforcement situation in our county.

Let’s give a try to outside control and see what happens! (If we do what you suggest, be prepared for possible state control over all of our tax districts - schools, port, cities, etc., not just public safety.)

I’ll march down Chetco Avenue with a “Vote ‘Yes’ for 8-71” sign posted on my anterior and my posterior if the county commissioners cut their salaries as they promised before the election. (Any chance this could happen in time for the Azalea Parade?)

Burden on our Backs - Don Vilelle - Brookings

Everyone has their own reasons for wanting or not wanting tax increases.

So many reasons are spoken/written in general terms. I would like to tell you my reasons for voting against the upcoming May property tax levy using specifics.

If the levy passes, our property tax will increase $942.78 a year (wish I owned a half-million dollar home and I'm supposed to bleed for you?) — for a total property tax of just under $6,000 a year! And on the heels of that, Brookings will increase water rates 3.9 percent and sewer rates 4.9 percent (sewer fees alone almost $680 a year).

Does Curry County need additional monies? Yes, since our federal government cannot balance its own checkbook and goes back on its word. Why do our county commissioners want to place all of the burden for additional county monies on the backs of property owners?

Everyone should help out — homeowners, renters, tourists. That can be done with a 2- to 4-percent sales tax put into effect. (Kitchen Table and Citizens Committee recommended the Property Tax would be the quickest and simplest way to finance the county. Any sales tax would be very difficult and costly for small businesses to implement and talk about something that probably wouldn't go away. Besides, it hurts those on fixed income the most.)

Property tax – “No” Sales tax – “Yes.” (And probably an "Income Tax" if Salem has to take over because the November, 2013 is too late.)

Can You Imagine? - Clifton Siemens - Brookings

Thank you Gerry Kass, (Pilot, April 14); now there are six of us.

Once again, the Pilot misspeaks, the crisis in Curry County is 20 years old not two. The original three million that started this crisis is seldom mentioned, except in passing. There are simple solutions to this so-called doom.

The cost of three commissioners will support four deputies.

A 10-percent cut in the salaries of all public employees would be a miracle for the whole country. (Ask your friends in the private sector if they think it would be reasonable for their employer do an across the board cut their salaries by 10% and asked them to pay 25% of their benefits and medical insurance. Who, in their right mind, would move to Curry County who is still working for a living?)

Twenty-five percent participation by public employees in their benefits and medical insurance is not unreasonable.

If a supervisor can not do the job his employees are required to do he should be terminated and the employees should be able to supervise or they should be terminated. (What kind of business school did you go to? Supervisors and employees have different skill sets and a business owner hires the best person for the job. It would be nice if employees would stay long enough to promote qualified ones to supervisory positions, but that's pretty much history, in most cases.)

The state is talking about a sales tax; if the county had or would enact a sales tax and the state did the same, Can You Imagine. (Yes. Those on fixed incomes, especially those who don't own property affording capital gains, would really be hurt.)

A month or two ago I suggested the commissioners would do nothing until the tax measure was voted on — Ta-da. (What's your point? Obviously, you don't attend Commission meetings.)

Curry County finally made the national news. Not because it’s a great place, because it’s broke. The city of Brookings is raising fees again; no cuts, no furloughs, just more fees. Put the property tax and new fees together and you have a new disaster. (Vote against 8-71 or don't vote at all, and you deserve what you get. A miniature Grants Pass.)

Simple solutions to complex problems.

Preposterous Tax - Mike Schrum - Brookings

My fellow citizens, the idea of passing a property tax at this time is preposterous.

The cost of living continues to go up every month; especially food prices, health insurance, drugs, fuel, etc. And ... congress keeps threatening to reduce Medicare and Medicaid (which could happen in the next five years). Then there is the threat of Social Security slowing down COLAs, not to mention cuts to Head Start and Meals On Wheels.

Scaring old folks with threats of crime and the Mexican Mafia is reprehensible. (Scaring old folks by telling them they don't need public safety could be construed as criminal.)

If you think the tax will go away in five years, I’ve got some oceanfront property to sell you located in Kansas. Five year tax, what, are we, stupid? (Well, since you ask, I'd say yes since it doesn't appear that you've bothered to read the bill. The ONLY way it could be extended is by another vote of the people.) I guess we will find out, eh?

I’ve offered suggestions, not one reply. Think it through folks. We need our money more than the sheriff does. (Do you realize that you've just told those who might like to relieve you of all your money, that you don't need the Sheriff to protect you? If the Measure fails, all they'll have to do is wait until the staff's are reduced, and misdemeanor thieves are released without charges.) I'm sure Vote NO on 7-81 and extend (try "reduce") the time you can afford to live here. (Actually, it will cost you more, either way, to live in Curry County. A YES vote will no doubt save you more than if Salem comes in."

Regret Vote for You - Jim Clarkson - Brookings

Law Levy? Let the guilt trips begin. It has been said that it will only cost us an additional $1 a day. Maybe for some, but it would cost me $2 more, added to the $13 I presently pay and it ceases to be fun. Since we have the second lowest tax rate of any Oregon County — which is at the heart of the problem, why are the other counties with higher rates also broke? (Actually, all 34 counties have higher tax rates but the six who are having trouble are all well below the median tax rate amount Oregon counties.) Raising rates doesn’t sound like the answer. (The Citizens Committee and the public through the Kitchen Table survey seemed to think it was the best one to immediately keep the county solvent.)

It’s been known for years that the O&C funding would end. But when times were good, O&C money was there, building was booming, development fees were abundant and tax rates were not an issue. Well, nothing is forever. Our rates were even flaunted as a means of drawing in new business and new money.

Now we’re broke. We need a new jail, more jailers, more prosecutors and more probation officers. Our law enforcement is busy busting perps with less than an ounce of marijuana for the associated $1,300 fines — which will never be paid. This is a system that needs more money thrown at it? This system needs fixing. I admit that I don’t have an immediate answer but then I’m not being paid to find one either. (Except you are complaining without a solution while others are actually actively trying to find something that might work, as suggested by the Citizens Committee and the Kitchen Table survey. To borrow a line from Danielle Steel - people are working hard to make a cake with the best ingredients we have right now and the best you can do is sit on it.)

To OUR ELECTED OFFICIALS: we are paying you to be leaders. Quit whining and using petty scare tactics. True leaders don’t have time to bellyache. For what you’re being paid I expect you to come up with reasonable solutions. (You apparently haven't been reading the paper for the last year.) And if you don’t have any, other than increasing my property taxes by $700 a year (this time), then I don’t want you to represent me. For those of you I voted for, I truly regret it.

I’m voting against 8-71, the alleged law levy.

Strange Bedfellows - Mike Adams - Brookings

It’s in the bag,” is the message being trumpeted by Curry County by Commissioners Smith and ltzen, on their predicted outcome of the seriously flawed ballot measure 8-71.

Say it often enough and loudly enough seems to be the mantra for ensuring their bag doesn’t come up empty. As for the volume of their message, it has been sufficient to be heard across county and state lines and resonate with an entity that has no business, at the time of this writing, in Curry County.

The April 30 edition of the Pilot includes an article titled “Tax levy PAC gets financial support.” The report identified the Smith River Rancheria as the largest single contributor. The “Tribal administrator” for the Rancheria stated three reasons for Rancheria dollars being donated to the PAC; these include a claim of ancestral lands, the welfare of tribal members residing in Curry County, and a concern for Curry County’s economic stability and local control.

The Rancheria website claims the Tolowa Tribe’s ancestral territories extend into Oregon to the Sixes River. Although the subject can’t be debated here, the research evidence cited by noted archaeologists and cultural anthropologists (So what. It's what the government recognizes for these purposes and what the tribe recognizes as the locations of their tribal members.) identify the Smith River as the tribe’s northern ancestral boundary. Does this claim represent a signal that the Rancheria has plans to expand its economic and political interests across the state line?

Many, if not most of the tribal members, have complained they were neither informed nor consulted on the question of the Rancharia’s financial support for Curry County’s tax initiative. (And your source is?)

Is it coincidental that the Rancharia’s land claim, in this instance, extends to the Pistol River, which is also the site of the Crook Point Golf Course project?

If our two commissioners can take a break from their “fear mongering,” perhaps they can devote some time in assessing the suitability of their bedfellows. (Sounds like very appropriate "bedfellows" to me!)

5/15/13

Yes or No, You Pay - Ryan Scott - Harbor

I wish to raise some concerns with 8-71.

1) Are the funds to be dedicated to law enforcement and emergency services? (See the proposed 2013/14 budget if Measure 8-71 passes.) Sheriff services in county areas have been spotty for over 10 years. They are always too busy when our area called for services.

2) If sheriff and emergency services do not use all funds collected, will the excess funds be held for the next year? There is a history of money being spent frivolously in Curry County.

3) Although they say the tax increase if only for five years, politicians historically never cut back funds. I fear they will say to us, "We now have a safety service district and the rates you voted for will now be permanent." (Please read Measure 8-71 before making outlandish statements like this. The measure ENDS in 5 years or less. A new vote would be required to continue a similar measure.)

4) Why in a county of 60,000, do we have three full salaried commissioners? We could drop two and replace them with a volunteer oversight selection. (Who do you have to volunteer for those positions and are they willing to work full time to handle the counties business?) That alone will save close to six figures. (BTW: We need a lot more than six figures.)

Either way you vote, you will be paying through an increase in taxes. (Finally we agree except that Measure 8-71 will cost citizens less.)

My worry is with the local political situation. They created the problem; I fear it's just more of the same. (Actually, the citizens of Curry County created the problem by continually refusing to be responsible for the county and begging for handouts from the State and Federal Government, which they are still trying to do. BTW Saying the state will pickup 50% of the tab is not currently part of 3453 and, most likely, never will be.)

I do not support 8-71 - Patricia Ramsey - Brookings (Note: Patricia Ramsey doesn't speak for all Republicans.)

At the April Curry County Republican Central Committee meeting, after a long, confusing, and uninvited presentation by Commissioners Itzen and Smith on tax levy Measure 8-71, the approximate six members present voted to support the levy.

A resolution stating this support, previously prepared by Commissioners Itzen and Smith, was passed around for all to sign. Although I did sign the document, after thinking it over I now wish to dissociate myself from Measure 8-71.

I do not support tax levy Measure 8-71, and will vote against it as I believe it to be an unfair burden to the property owners of Curry County. (But you are, it seems, okay with putting an unfair burden on income tax payers and people on fixed incomes who might have to pay sales tax AND risk the possibility that Salem will use money currently allocated from the County Fund for schools, ports, cities, and other tax districts, to pay their expenses to do our work for us?)

I also believe that these two county commissioners made up their mind that they were going to cram this tax levy down our throat, (you forget this was an option of the Citizens Committee) just like the progressive Democrats forced Obamacare through our federal legislature and have used the same distortions of the truth and bullying tactics that they used. (Sort of like the Iraq War and the trillions given the wealthy by the Bush "Temporary" Tax Relief to supposedly add jobs to the economy?)

Please, all remember that the Republican Central Committee does not speak for all Republicans.

None of the articles published in this newspaper have made that distinction. (You think it is really needed? I don't know of any organization, except maybe Sutter Health, where virtually everyone agrees with their board and all members of the board basically agree. But, that may just be obvious to me.)

5/18/13

silence is deafening - Roger Mitchell, Brookings

I read David Brock Smith’s letter in the Curry Pilot on May 15, 2013.

As chair and obvious spokesman for the Curry County Board of Commissioners he states nothing new, just business as usual. We have spent all you have given us, please may we have some more? (Seems you've missed the point. You haven't been paying for the Counties total expenses since 1975. Not even half of the expenses. You've been living off the Federal Government. Sounds like a college graduate scenario. Now it's time to grow up and either pay rent or move out. Take some responsibility.)

What better time to unveil new policies? With county employment at an all time low, how about some plans to ask new employees to make a larger contribution to their pensions and health benefits? The unions probably would not let them change the conditions for existing employees. How about the commissioners taking pay more in line with the average pay and benefits of the local population? (Boy, I didn't realize their salaries accounted for $4.5 million in expenses.) The silence is deafening.

Our problems are not local. Many public agencies are negotiating their financial obligations downward.

I see the need to replace some of the timber income but will not vote for a tax increase without some changes to make our local government more affordable (So what efforts do you need to be happy? They keep cutting jobs. Give us some direction just not "some changes to make our local government more affordable) and have it offer alternatives to a property tax. (They took the recommendations of the Citizens Committee and the results from the Kitchen Table survey. The alternative is HB 3453. Are you Happy now?)

What is Measure 8-71? A 5 year Curry County Law Enforcement Split Rate Operating Levy dedicated to fund Public Safety services such as: Jail Operations, 911, Criminal Investigations, Sheriff Patrols, Drug Enforcement, Juvenile Detention Services, District Attorney, Adult and Juvenile Prosecution and all other Emergency Services

Why do we need Measure 8-71? Curry County no long receives Federal timber payment subsidies. Measure 8-71 will provide revenue needed for essential mandated public safety services. This will give our county commissioners 5 years to work with our community to find more effective means of supplying this essential revenue.

How can I estimate my property tax increase? You may have heard rumors of huge increases with Measure 8-71. Don't believe rumors. Find out for yourself by going on the Internet at www.co.curry.or.us and scroll down to the tax calculator. In just a few minutes you can estimate your annual, monthly and daily increase.

In figuring that rate, how does Assessed rate

vs. collected rate apply?

These are my interpretations based on the text of the bills and

descriptions published in the media. It's kind of hard to figure this

stuff out. The text of the bills contain a lot of legal jargon that's

hard to interpret and must be understood in the context of other law

and regulations. Press coverage tends to be spotty and superficial.

So caveat emptor.

How much will my increase be?

If your home is in Brookings, Gold

Beach or Port Orford, add $1.84 per $1,000 assessed value. For

property owners outside city limits add $1.97 per $1,000 assessed

value. For the median home in Curry County, that's less than $0.91 a

day. For a million dollar home, it's less than $5.40 a day.

Where do I find the assessed value of my

home that will be used when this takes effect?

A property’s assessed value may be found on the owner’s

Property Tax Statement midway down the left side of the Statement, it

is the property’s NET TAXABLE value. Property owners may also

contact the Assessor/Tax Collector’s Office at 541-247-3294.

What happens if a better funding

source for the County becomes available before the 5 years is up. Are

we committed to continue charging property owners the increased

tax?

My understanding is that the BOC can and will cancel the tax

increase if the financial situation of the county changes for the

positive before five years. The sunset is mandatory and an extension

of the levy would require another vote. Lots of people are cynical

and think that the Commissioners could just extend it past five

years. That's a myth.

What will happen if it fails?

No one is sure, but since many of our county services are

mandated, the state of Oregon is considering bills which would allow

the state to provide these services for us. Of course, the state

wouldn’t do this for free, so a surcharge would be added to the

state’s cost, and charged to Curry County citizens. This could

very possibly result in a surcharge on our income taxes and a

reduction in funds for our cities and various districts such as

schools, libraries, fire, and ports.

What is Oregon House Bill 3453

and how might it affect Curry County Citizens? House Bill 3453

allows the Governor to take control of county public safety services

in the event of a financial emergency. These services include sheriff

patrol, the jail, 911 services, criminal investigations, crime

prevention, search and rescue, marine patrol, civil process service,

juvenile detention services, traffic safety, school resource

programs, adult parole and probation, wildland fire and tsunami

evacuations, emergency services, and drug enforcement, prevention and

education, and others. The money needed to continue these services

will come from an income tax assessment (increase) on residents of

the county. See

full text.

(http://openstates.org/or/bills/2013%20Regular%20Session/HB3453/documents/ORD00009151/)

What is Oregon House Bill 2206 and how might it effect Curry County Citizens? House Bill 2206 allows Secretary of State to assume control of essential county functions in counties for which the Governor has declared a public safety services emergency due to fiscal distress. These essential functions include the country treasurer, elections, veterans services, tax assessment and collections, and municipal code inspection and enforcement. The money needed to continue these services will come from existing county property tax revenues, decreasing the amount of property tax monies received by agencies and districts such as city governments, schools, fire departments, and libraries. See full text. (http://openstates.org/or/bills/2013%20Regular%20Session/HB2206/documents/ORD00007042/)

What is Oregon House Bill 2168

and how might it effect Curry County Citizens? House Bill 2168

allocates to counties the proceeds from the sale of tax-delinquent

and foreclosed properties to pay delinquent county general fund

taxes. This bill would give counties first priority in recovering

property tax revenues, potentially depriving other jurisdictions of

revenue from these sales. This bill was proposed by Representative

Wayne Krieger. See

full text.

(www.currypilot.com/News/Local-News/City-Council-opposes-House-bills)

What is Oregon Senate Bill 173 and how might it effect Curry County Citizens? Senate Bill 173 would provide a “service delivery technical assistance program” (what City Manager Gary Milliman calls “advice”) that would award “public bodies” – in this case, Curry County – grants for service delivery innovation, encourage municipalities to enter into public-private ventures to provide technical assistance to the county and convene task forces to advance those goals. See full text. (www.currypilot.com/News/Local-News/Council-supports-alternative-senate-bil)

How much has assessed values of homes in Curry County gone up or down by year for the last five years?

|

|

|

|

|

|

|

|

|

|

|

|

What if I can't afford to pay?

Oregon has a property tax deferral program for disabled and

senior citizens (aged 62 or older). For those who qualify, the state

will pay the property tax bill and a lien is placed against the

property. Deferred taxes are collected from the estate upon the death

of the property owner. www.oregon.gov/dor/forms/property/deferral-disabled-senior_490-015.pdf

or http://1.usa.gov/13nGFJm

HB 2489A extends the ability to participate in the Senior and Disabled Property Tax Deferral Program to seniors who had been previously disqualified due to having a reverse mortgage. www.leg.state.or.us/press_releases/sdo_032813b.pdf

Veterans who meet low income requirements may be eligible to exempt a portion of their assessed value from property taxes. This wouldn't cover their whole tax bill, but if they're not already claiming this exemption, it might be a significant help when the rates increase. (www.oregon.gov/dor/SCD/Pages/veteran.aspx)

Help for struggling senior homeowners

HR 2489A

The Senior and Disabled Property Tax Deferral Program allows

seniors and disabled individuals who have qualifying incomes and meet

other criteria to defer county property taxes; the state is repaid

when their homes are sold. Given the housing crisis of recent years

and increased demand, the program was on the verge of insolvency

until the Legislature made significant changes to protect the core of

the program. While the changes maintained program solvency, those

changes also created an unexpected hardship for some vulnerable

homeowners. See

full text.

What happens to the County's Public Safety if 8-71 fails?

1. Patrol: who is going to answer the assault calls, burglary,

trespassing, and other calls we do every day. What about the mandated

Child Abuse and Death Investigations. (Sheriff is only one who is

mandated to conduct these investigations)

2. Jail to incarcerate all prisoners and meet the daily

requirements.

3. Court Security for hearing and trials. Not only criminal but civil

trials as well.

4. Law suit mitigation which could affect all citizens

5. Search and Rescue, who will maintain, train and conduct missions

for lost people.

6. Supervise Marine Patrol and Rescue on all six rivers and the

ocean, and education of our children on water safety.

7. Community Corrections (Parole and Probation) who will see that

treatment is being provided and that the convicted are adhering to

the court’s orders. (Sex offenders, Drug User dealers)

8. 911/EMD. Who will answer 911 calls and then dispatch them to

police fire and medical, along with command and control of the jail

facility

9. Who will keep all of the radio licenses, and FCC mandates for our

towers, who will help maintain out communication system.

10. Who will oversee the Emergency Services plan, and then during an

emergency event who will provide the leadership and expertise during

the event to mitigates lives being lost and property being

damaged.

11. Who will oversee and do all civil processes (order of the court)

including restraining orders, protection orders, summons, Eviction

papers, civil law suit papers, foreclosures, etc.

There are 1648 square miles in Curry County.

While the cities in Curry County contain over 43% of the population of the county, property owners in the City will pay less than 37% of the property tax generated by the County Five year Local Option Tax for Law Enforcement Purposes.

According to the 2012-13 Oregon Property Tax Statistics publication

- The average county only Tax Rate for Oregon’s 36 Counties is $2.90/1000 assessed value (AV)

- Curry County’s tax rate is $0.5996/1000 AV (second lowest in the state) or 21% of the State average

The average City only tax rate for Oregon Cities is $5.43/1000 AV

- Brookings tax rate $4.6352/1000 or 85% of the State average

Gold Beach tax rate $2.3360/1000 or 43% of the State average

Port Orford tax rate $3.5788/1000 or 66% of the State averageThe state average combined tax rate for all areas and districts is $15.67/1000 AV

- Curry County has the state’s lowest average combined tax rate of $8.68/1000 AV

If the County Five year Local Option Tax for Law Enforcement Purposes is approved by voters Curry County will still have the fourth lowest combined tax rate in the state behind Josephine, Klamath and Polk counties.

The county tax calculator is wrong! Some people don't’t trust the tax estimate calculator on the county website. Why not? Easy answer: They read in the newspaper that the increase would be thousands of dollars, and the calculator didn’t give that kind of answer. Letters to the Editor right. County wrong. Then do this. Find the Assessed Value on your tax statement. Knock off the last 3 numbers and you get the value in thousands. Multiply that by $2.00 That's about what the increase will be. Now, go to the calculator at co.curry.or.us and see how close you've come.

Veterans Services Office assists Curry County Veterans and their dependents in obtaining service-connected and non service-connected disability benefits, medical benefits, and educational benefits.

Total requirements - 2012/13 - $78,478

Proposed Total Requirements - 2013/14With Measure 8-71 - $135,592

Without Measure 8-71 - $69,466

End of the line

Counties facing financial collapse cannot complain if state steps

in.

Local government officials outraged that the state might take over insolvent counties should save their breath — and use it instead to campaign for tax levies to prevent their counties from sinking into insolvency. It is appropriate for the state to step in if the alternative is the complete collapse of civil government.

For now, we're speaking primarily about Curry and Josephine counties — the two closest to financial ruin. But eight counties, including Jackson, are identified in a Secretary of State's Office audit as being at risk of insolvency. The audit did note that Jackson County is in the best shape of the eight — for a few more years. Besides Jackson, Josephine and Curry, the list includes Coos, Klamath, Lane, Douglas and Polk.

House Bill 3453 would allow the governor to declare an emergency and levy new taxes on residents of an insolvent county to pay for police or other vital services.

The mayors and city councils of Curry County's three cities have gone on record opposing the bill. In a letter to Gov. John Kitzhaber, the mayors of Brookings, Gold Beach and Port Orford express fears that the legislation might allow the state to dissolve city governments or divert city resources to provide county services. City residents would therefore lose local control, the letter argues.

Curry County residents — whether they live in or outside of those cities — have a chance to show they are responsible enough to exercise that local control by voting in favor of a public safety levy on the May 21 ballot that would continue to fund law enforcement. If they don't, the state may have no choice but to step in.

Curry County residents pay the second-lowest property tax rate in the state — just 60 cents per $1,000 of assessed value. That once was enough, because proceeds from the sale of timber from former O&C Railroad lands in the county paid for county services.

That money is gone now, and Curry County residents and government officials have known for years that this day was coming. But they have refused to pay enough in taxes to become self-sufficient.

It is easy to gripe about government, which can be inefficient, overbearing and bureaucratic. But it is one thing to complain about it and try to change it for the better, and something else again to get rid of it entirely.

Contributing one's share to the common good is the responsibility of everyone who lives in a modern society. At a minimum, basic levels of public safety, roads, electricity and communications depend on at least some government.

The state has an interest in ensuring that

individual counties do not descend into anarchy.

Source: www.mailtribune.com/apps/pbcs.dll/article?AID=/20130414/OPINION/304140361/-1/NEWSMAP

If you would like to learn the results of the Tax Levy, wait until after 8pm on Tuesday, May 21, 2013 and then check the following web sites to track results:

Curry County: Scroll to the end of the document (page 22 or 22). Read County Law Enforcement Five Year Split Rate Operating Levy Measure 8-71

|

County Law Enforcement Five Year Split Rate Operating Levy |

|||

|

|

|

||

|

Registered Voters |

|

||

|

Ballots Cast |

|

|

|

|

Voter Turnout |

|

||

|

Yes |

|

|

|

|

No |

|

|

|

|

Cast Votes |

|

|

|

|

Under Votes |

|

|

|

Josephene County: Information not posted yet. Read Measure 17.49. Criminal Justice and Public Safety Three Year Local Option Tax

|

Criminal Justice and Public Safety Three Year Local Option Tax |

||

|

Registered Voters |

|

|

|

Ballots Cast |

|

|

|

Voter Turnout |

|

|

|

Yes |

|

|

|

No |

|

|

|

Total |

|

|

|

Over votes |

|

|

|

Under votes |

|

|

Lane County:. Scroll to the end of the URL and then go back 7 measures. Read Measure 20-213 Jail and Critical Youth Services, a five-year levy

|

Jail and Critical Youth Services, a five-year levy * |

||

|

Registered Voters |

|

|

|

Ballots Cast |

|

|

|

Voter Turnout |

|

|

|

Yes |

|

|

|

No |

|

|

|

Total |

|

|

The End